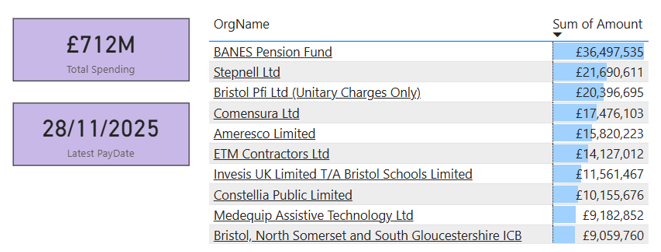

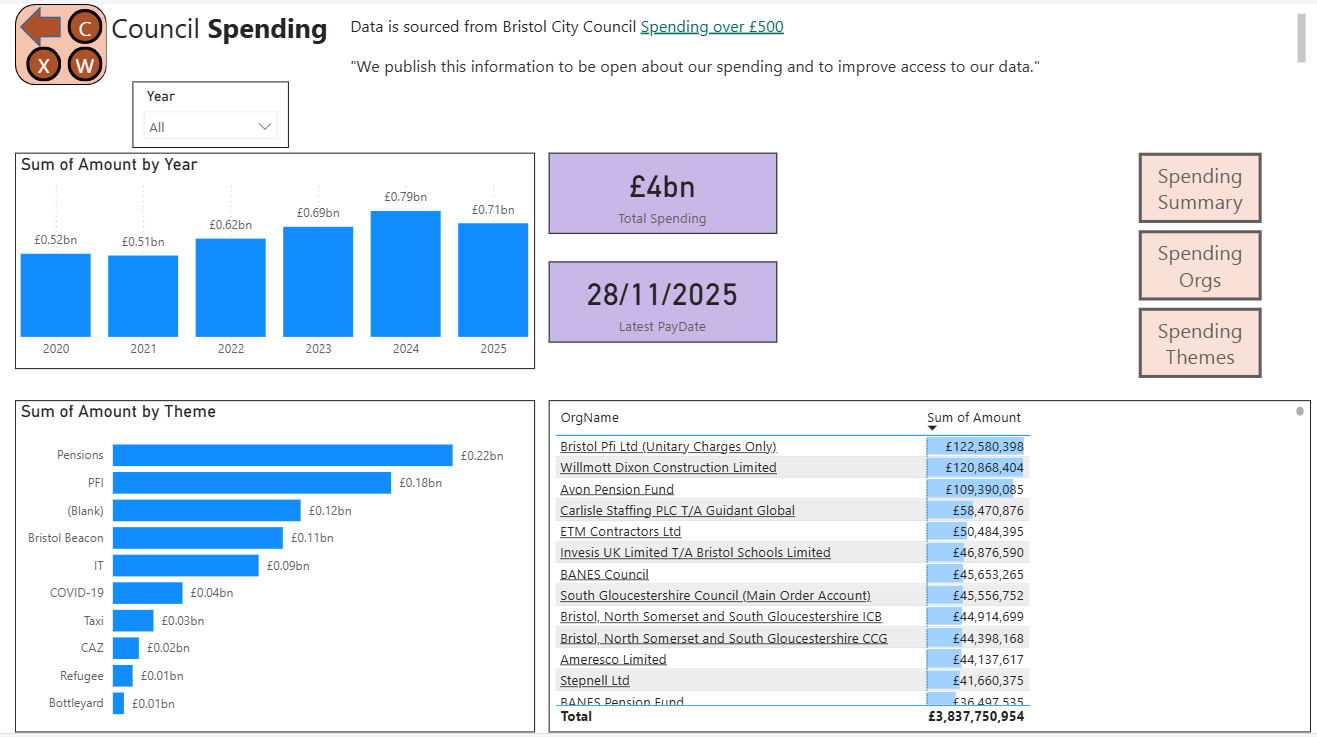

Council Spending 2025

BCC have just published their Spending over £500 data for November 2025, so I thought it might be a good time to look at what our money (£712 million) has been spent on so far this year (Jan to Nov 2025).

#1 BANES Pension Fund - £39,497,535

This figure shows that the cost of Local Government Pensions are very high in proportion to other spending categories.

The Avon Pension Fund(BANES Pension Fund is part of this) has been in the news recently when it voted to remain invested in the "aerospace and defence sector".

This decision was made because the fund did not want to risk losing income from this profitable sector and has a duty to maximise the value of the fund for the benefit of it's members.

If the Avon Pension Fund had decided to pull out of this sector then it would be likely that Council Tax Payers would have to pay even more money into the fund in the future.

At the Full Council Meeting on 14th Jan 2025 Councillors voted (57 For, 0

Against, 6 Abstaining) for the Motion: "CEASEFIRE IN GAZA AND ENDING THE UK’S ARMS TRADE WITH ISRAEL".

Which included this :

Call on our representatives on relevant bodies, including Local Government Pension Scheme funds, to develop an ethical investment policy that specifically seeks to divest at the earliest prudent opportunity from shares in companies engaged in arms manufacture or the trading of armaments, as well as from companies on the UN’s list of businesses involved in activities in the illegal-settlements in the Occupied Palestinian Territory and deemed complicit in human rights abuses.

This could means that our Concillors effectively voted to increase the costs required to fund the pension scheme. But the phrase "divest at the earliest prudent opportunity", gives them a clear opt-out, as divesting from this sector would be likely to make the fund less profitable and therefore would not be considered "prudent".

#2 Stepnell Ltd - £21,690,610

A building company who are involved in a number of housing developments in Bristol.

Looking at the "Gaza Motion" it also declares that:

councils must avoid procuring from or investing the funds they manage, including Local Government Pension Scheme funds, in companies that facilitate Israel's breaches of international law

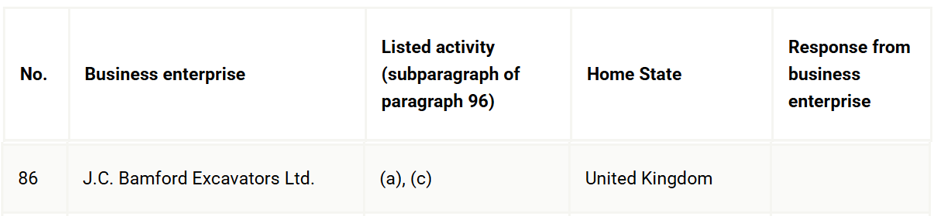

One of the companies on the UN Database of Companies that facilitate Israel's breaches of international law is JCB.

See: Database of Business Enterprises Pursuant to Human Rights Council Resolutions 31/36 and 53/25

See : Stop JCB’s Bulldozer Genocide - Nov 2025

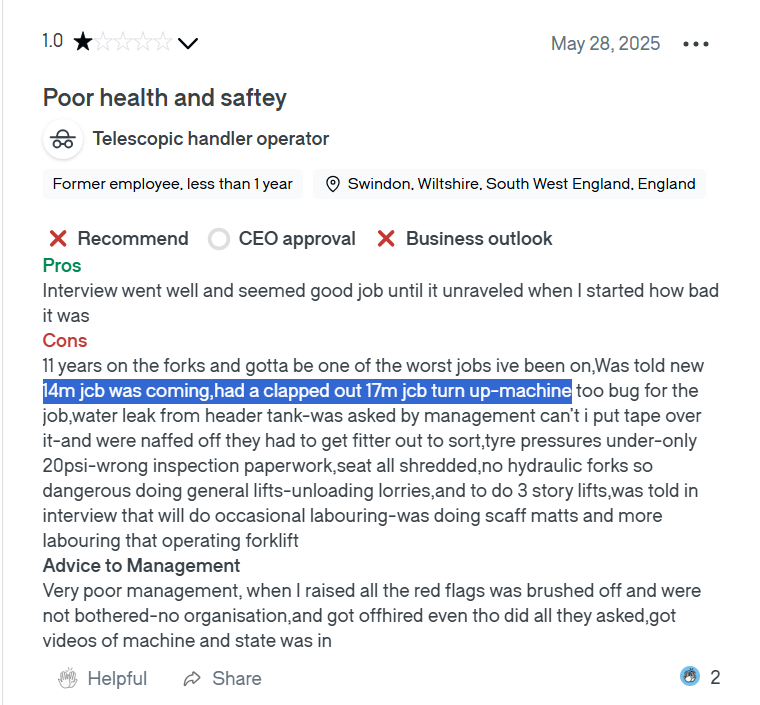

Whilst Stepnell Ltd are not directly involved in Gaza, they do use JCB machines as can be evidenced by this recent post on Glassdoor:

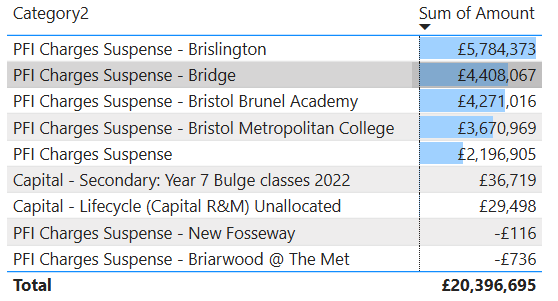

#3 Bristol Pfi Ltd (Unitary Charges Only) - £20,396,695

What is PFI?

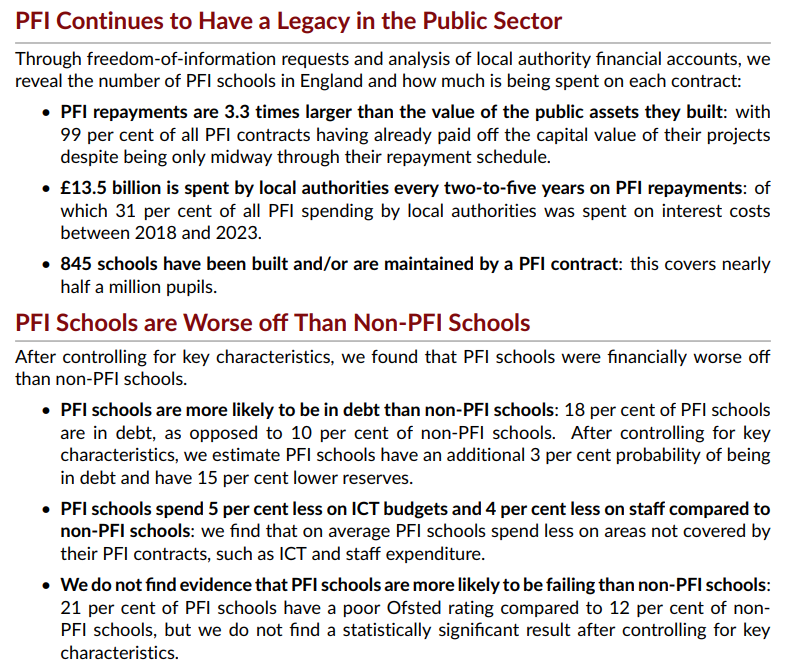

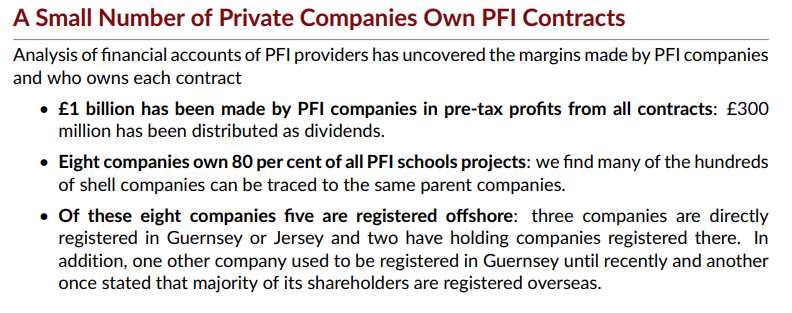

PFI: Getting the Bill on the Fiscal Credit Card

For over 20 years, successive UK governments used the Private Finance Initiative (PFI) - a form of a Public Private Partnership (PPP) – to use the private sector to finance and deliver public infrastructure projects. This model allowed for the payments of these projects to be repaid over decades and were often considered off-balance sheet, meaning they were not included in public debt figures and so not subject to spending rules. Despite delivering over £80 billion worth of public assets, the model was retired in 2018 after becoming synonymous with high costs and inflexible contracts and due to the ‘fiscal risks’ it posed the public sector.

What are we still paying for in Bristol?

Despite the acknowledged failure of PFI, the current Labour Government are planning to introduce a similar scheme to fund NHS facilities.

"Funding NHS facilities with private finance a breach of manifesto, Labour MPs say" - BBC 21 Nov 2025

One of the signatories, Cat Eccles, said: "I worked in the NHS for over 20 years and I saw firsthand the damaging effects of PFI on NHS trusts. Poor quality buildings with leaking roofs, inadequate layouts in clinical spaces, and spiralling debts that become impossible to tackle.

"In some cases the taxpayer is footing the bill for 10 times the cost of the original projects, leaving the NHS struggling to cover costs for staff and clinical services.

"This is unsustainable and we can't keep kicking the cost down the road. The NHS needs to be publicly funded and publicly owned to protect it now and for the future."

#4 Comensura Ltd - £17,476,102

Comensura provide agency staff to Bristol City Council.

#5 Ameresco Limited - £15,820,223

Bristol City Leap

“Bristol City Leap brings together the best of the public and the private sector – a partnership between Bristol City Council and Ameresco. We will create 1000 jobs over the next five years, many of which will be local jobs for Bristol people within Bristol postcodes. We’ll also deliver a great deal of funding to communities to enable community organisations, smaller organisations, charities, and community groups to deliver their own projects.” - Bristol City Leap

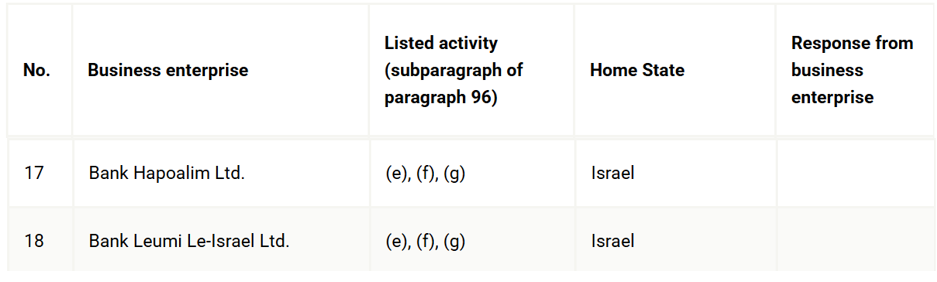

There is also some evidence that Ameresco are indirectly linked with companies on the Database of Business Enterprises Pursuant to Human Rights Council Resolutions 31/36 and 53/25

These 2 Banks are major investors in Atlantic Green’s Cellarhead Battery Energy Storage System (BESS) project.

The financing was provided by a consortium of lenders including Goldman Sachs, Santander, Bank Hapoalim, and Bank Leumi, with Goldman Sachs acting as the sole structuring bank, mandated lead arranger, and lender. This international consortium’s support underscores the global confidence in Atlantic Green’s mission to advance the UK’s clean energy transition. With a mission to develop a c.2 GW capacity of battery energy storage to fuel the UK’s clean energy transition, the Cellarhead BESS represents a key milestone for both Atlantic Green’s development journey and wider sustainability objectives.

Ameresco picked by Atlantic Green to deliver 300-MW British battery - May 2024

US renewables company Ameresco Inc has received a USD-249-million (EUR 229.9m) contract to supply and install a 300-MW/624-MWh battery energy storage system (BESS) project in the UK.

The engineering, procurement and construction (EPC) deal was awarded by Atlantic Green, a joint venture of Israeli renewables developer Nofar Energy Ltd and real estate and energy storage investor Interland.

Whether or not you agree with the BCC Gaza Motion, it does seem that it was more an exercise in virtue signalling, rather than a concrete action that leads to any meaningful change with relation to events in Gaza.

You can view the BCC spending reports in the usual place.

Comments ()