Bristol "Mansion Tax" might only apply to 60 properties

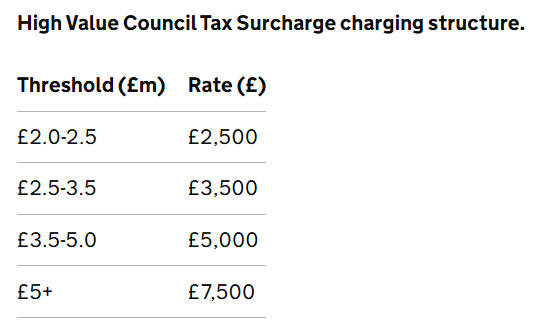

At the Budget this week a new "Mansion Tax" was announced. This new tax is actually called the "High Value Council Tax Surcharge" (HVCTS) and will be introduced from April 2028.

The Valuation Office will conduct a targeted valuation exercise to identify properties above £2 million and therefore in scope. Fewer than 1% of properties in England are expected to be above the £2 million threshold. Revaluations will be conducted every five years.

Under the current system, the average band D charge for a typical family home across England is £2,280. That is £250 more per year than a £10 million property in Mayfair, based on the band H charge in the City of Westminster, currently pays. This surcharge will change that, implementing a significant reform to improve fairness within England’s property tax system.

Properties above the £2 million threshold will be placed into bands based on their property value. Charges will increase in line with CPI inflation each year from 2029-30 onwards.

So, what does this mean for Bristol?

Bristol City Council will have to collect this new tax, but will be fully compensated for the additional costs of administering the HVCTS. The revenue from this tax will go to the Treasury into the general spending pot. This means it should be thought of as an increase in general taxation rather than an increase in Council Tax as none of the revenue raised will be directly allocated to Bristol City Council.

The vast majority of this tax will be raised in London and the South East. This tax is a form of a general "wealth tax" where most of the money raised will not be allocated to the areas where it is raised.

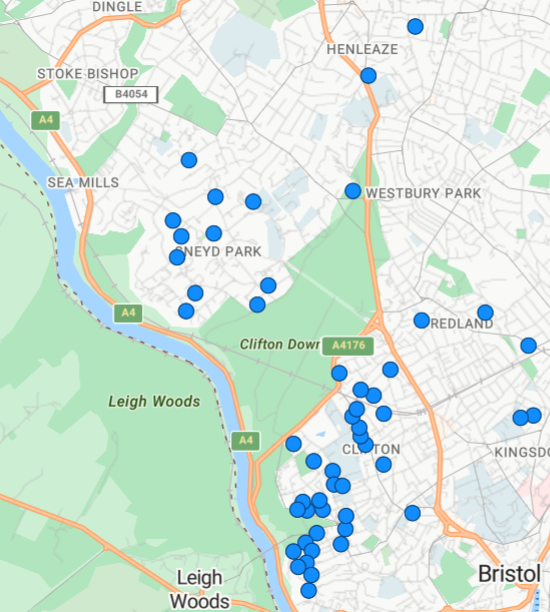

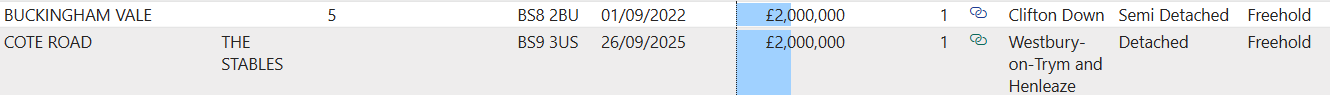

Bristol Properties valued at £2,000,000 or more

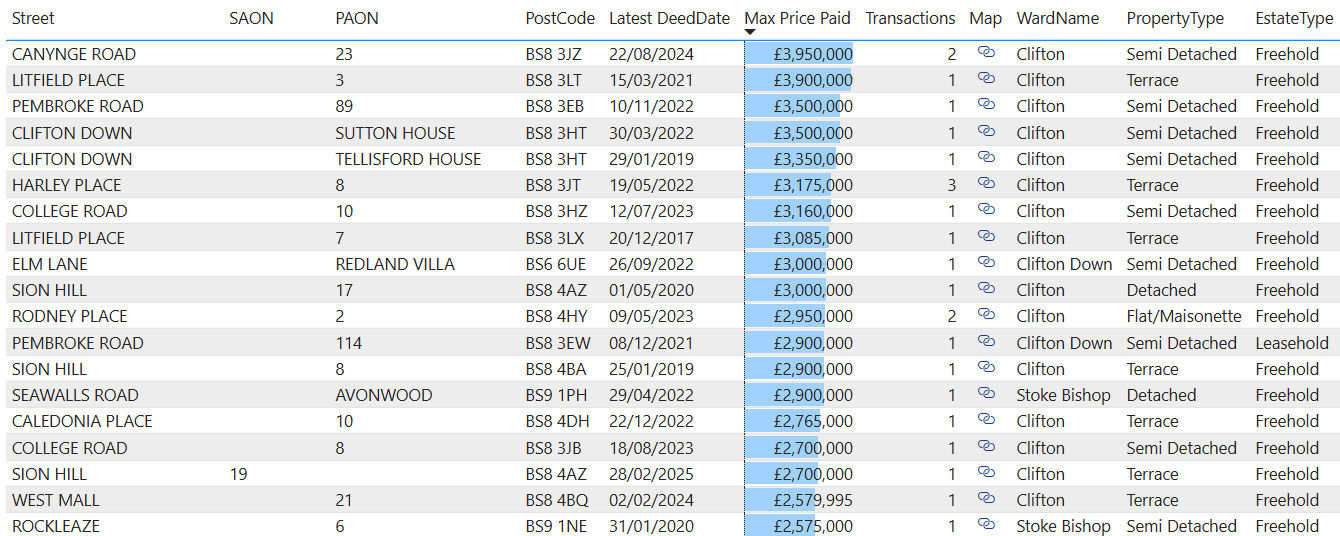

The Land Registry "Price Paid" data identifies the price of properties that have been sold between 1995 and October 2025. This data does not provide valuations for all properties in Bristol, but does give a good idea of how many properties are worth more than 2 Million Pounds and where they are located in Bristol. The report will not contain data for properties that have not been sold since 1995. All properties will be re-valued as part of the introduction of this new tax. Properties will then be revalued every 5 years.

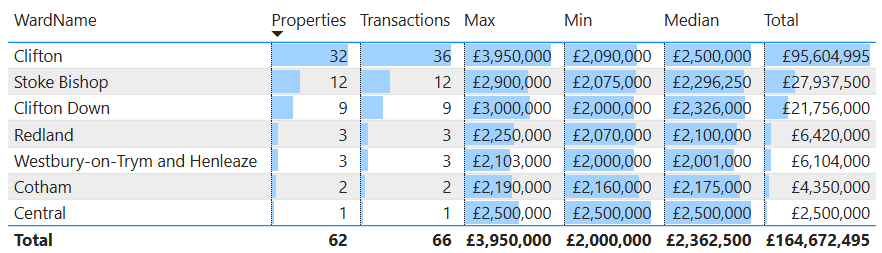

There are 62 properties in Bristol that have been sold for £2 million or more since 1995.

A few of these properties are clearly commercial properties that are not residential, but the vast majority are residential.

If each of these properties paid an average of £3,000 HVCTS it would raise £186,000, which is likely to be less than the cost of administering this tax in Bristol. Is that really good value for money?

The only logical reason to introduce this new tax is if the government plan to extend this scheme to cover more properties in the future, and possibly to change the current Council Tax system to bring in more revenue.

Comments ()